HECM vs Jumbo – Which Reverse Mortgage Product Is Best for Your Client?

- Luis Salazar

- Aug 28, 2025

- 1 min read

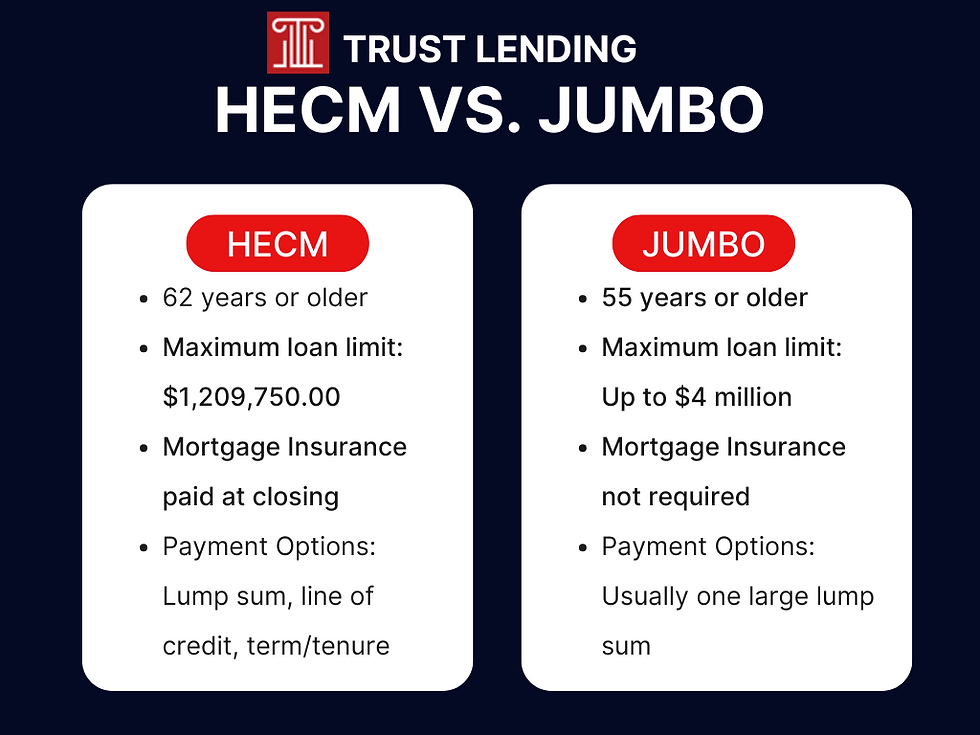

Not all reverse mortgages are created equal. As a broker, understanding the difference between HECM (Home Equity Conversion Mortgage) and Jumbo/Proprietary Reverse Mortgages is key to recommending the right product for each client.

What Is a HECM Reverse Mortgage?

Backed by FHA and insured by HUD

Designed for homes up to FHA lending limits

Offers protections like mandatory counseling and non-recourse guarantees

What Is a Jumbo Reverse Mortgage?

For higher-valued properties above FHA limits

No HUD insurance, but more flexible loan amounts

Often used for borrowers with significant home equity

When to Choose Each Product

HECM: Clients want FHA protections, standard loan limits, or line-of-credit features.

Jumbo: Clients have high-value homes and need access to larger loan amounts.

Want a product comparison cheat sheet for brokers? Request your free guide here and help clients make informed decisions.

Comments